Check cashing services are popular for a number of reasons, including reasonable fees, convenient service and immediate access to cash without waiting for the check to clear. Let’s take a deeper dive into the “what” and “why of check cashing services below!

What is a check?

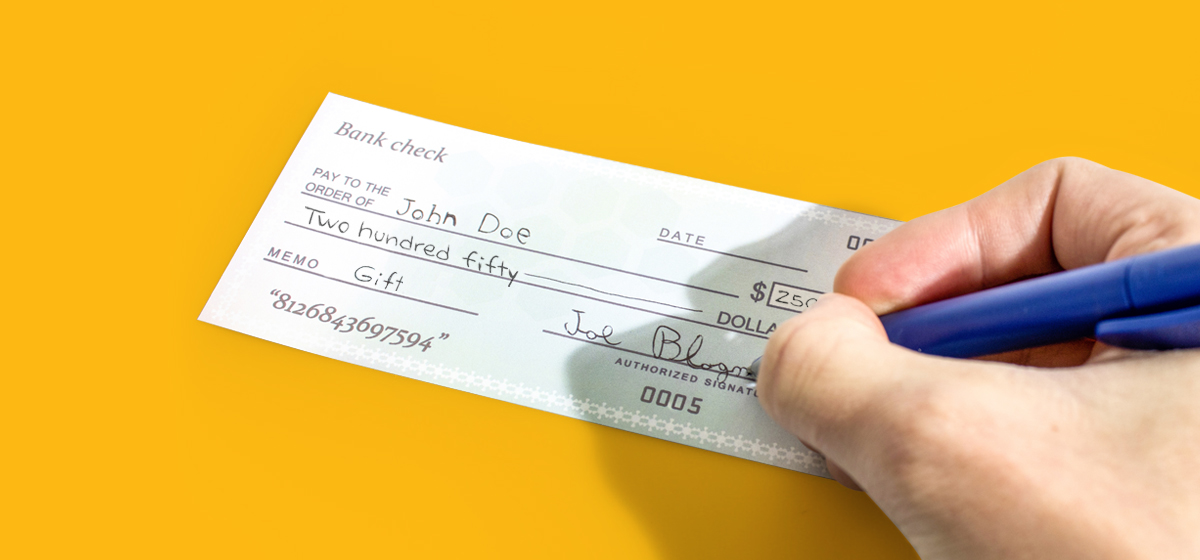

A check is a “negotiable instrument,” meaning it is a signed document that promises payment in a specified amount to a specified person/entity. Checks were invented to make it a whole lot easier to give someone a piece of paper promising to pay rather than having to carry around piles of cash! The person (or entity) writing the check is known as the “maker” and the person to whom the check is written is the “payee.” When the payee “negotiates” a check (i.e. endorse the check and exchange it for cash) the maker’s bank is instructed to transfer funds from the maker’s account to the payee’s account or the party to whom the check has been endorsed. Sounds simple, right? Sometimes it is, but other times it can take what seems like forever to get your funds!

Why use a check cashing service?

Check cashing services allow the payee to endorse a check over to the check cashing business, and then pay a fee in exchange for what is typically immediate cash. No need to deposit the check into a bank account or wait for the check to clear the maker’s account.

If you’ve never used a check cashing service (maybe you’ve always deposited or cashed your checks at your bank), you might be wondering “why would anyone pay a fee to cash a check?” Well, many people have weighed the costs and benefits and decided that check-cashing services are the best choice. Let’s have a look.

First, let’s talk about the fee. 15%? 10%? Nope! In fact, take your run-of-the-mill paycheck. Moneytree charges a low 1.99% to 3.99% plus a transaction fee of $1.99 to $2.99. Wow – that’s not a lot of moola for immediate access to your check cashing funds without the hassle of involving a bank! Rates are subject to change and may vary by location. To find out how much it’ll cost to cash your paycheck or other types of checks in your market area, visit our Moneytree Branch locator.

Second, to deposit or cash your check at a bank, you need a bank account. But what if you don’t have one? Lots of people don’t. Having a bank account can be expensive and many people may decide that the costs of maintaining a bank account outweigh the benefits. And there are other reasons. According to a survey by the FDIC, people choose not to have a traditional bank account for reasons ranging from “don’t have enough money to meet minimum balance requirements” to “don’t trust banks” to “fees are too high.”

Third, even if someone does have a bank account, it doesn’t mean cashing a check there will be easy. Banks have a lot of restrictions on what kinds of checks they will cash and in what amounts. Bank hours are limited, and banks typically don’t cash checks for people who don’t have an account at that bank. Talk about inconvenient!

Finally, banks don’t always give you immediate access to your cash and will frequently place “holds” on check transactions. A “bank hold” or “check hold” is intended to shift the risk that the maker’s bank account will not have sufficient funds in it when the direction to transfer funds is given. Banks don’t like the risk of losing on a check, so they “wait” to provide cash or credit to the payee until after they have the money from the maker’s account in hand. That might make sense if you are a bank, but what if you need immediate access to your money today?

That’s where Moneytree comes in!

At Moneytree, we cash many types of checks and we don’t have maximum dollar limits. Moneytree doesn’t put bank holds on check cashing proceeds, so our customers typically get their funds immediately. In addition, our check verification processes are fast and convenient and we accept most forms of ID. And, Moneytree’s Refer a Friend program offers you a cash-in-hand bonus for any customer you refer to us who cashes a qualifying check for $100 or more!* Easy money.

There are a lot of great reasons to visit your local Moneytree to experience our check cashing services for yourself. Or you can learn more at moneytreeinc.com.

Looking for more information about Moneytree services? Read up on our What We Do page.

*To qualify for a cash referral, your friend must (1) be a new Moneytree Customer (i.e., never having previously cashed a check at Moneytree) who (2) conducts a Qualifying Transaction. Qualifying Transactions are check-cashing transactions in which the face amount of the check is $100 or more. Current employees of Moneytree or its affiliates are not eligible to participate in this promotion.

Updated Oct. 2023