There it is … you have a message notification on your phone, but open it to find it isn’t what you were hoping for. Instead of a text from your bestie, it’s your online bank account statement for the month, and the balance is much smaller than you were expecting. How did you manage to spend $230 at Target … again?! What’s with all the ATM withdrawals? Did you really need the $49 dog sweater? Maybe. These may all be tough questions to answer, but there is one simple solution to your overall money management challenge: A budget.

Budgeting may sound daunting, but not to fear, Moneytree is here to help teach you how to budget like a pro in just five simple steps. Whether you’re looking for ways to save more, limit unnecessary spending, save for a special purchase or simply find out exactly where all your money is going, you’ve come to the right place!

Step 1: Calculate your income

The first step to creating a budget is finding out exactly how much money you’re working with. Sounds simple – but it can actually be pretty tricky if you don’t know what to look for. What you’ll need to figure out is the actual income available to you for paying your expenses, savings, and “mad money.” For most of us, our paycheck will reflect a “gross income” and “net income.” Some paychecks may also state “taxable income.” Word to the wise – they are not all the same.

- Gross income: This is the amount of money you earn before anything is taken out in taxes or deductions. So, your gross income would be something like the salary you were offered when starting a new job (ex: $40,000/year). But, your actual take-home pay will probably look different.

- Net income: This is the number we’re looking for to begin building our budget as accurately as possible. The net income is the amount of money you actually receive after taxes and other deductions (for example: the amount that is deposited into your bank account on payday).

- Taxable income: This is the number used when calculating income tax, and represents the portion of your paycheck that can be impacted by taxes. Certain types of income cannot be taxed, so your taxable income serves as a guideline when considering certain deductions.

You are looking to identify your net income – or the amount that is paid directly to you after taxes and other withholdings (like premiums on employer-provided insurance and 401k savings deductions).

Once you’ve identified your net income, multiply that by the number of times you get paid that income each month (e.g. if you’re paid weekly it would be net income x 4, if bi-weekly it would be net income x 2).

Step 2: Assess your expenses

Peruse your bank and credit card statements – get familiar with your spending and current lifestyle expectations, i.e., nightlife, gym membership, or weekly takeout (the reason you got that gym membership). Get a firm grasp of your monthly recurring expenses like grocery costs, rent, utilities, or TV subscriptions and document them in great detail. Next, separate your spending into two categories: Essentials (groceries, rent, bills) and non-essentials (fruity cocktails, TV subscriptions, takeout). Have these items, and an understanding of which category they fall into, ready for step three.

Step 3: Break down your budget

From steps one and two, you should start to get an idea of exactly how much money is coming in and going out each month. This is where the fun comes in – you now get to break down your very own budget and take the first steps towards reaching your financial goals. Ask yourself some questions: How much do you want to save each month? How much do you want to spend on recreational or entertainment activities? How much is your current cost of living? Establishing some realistic objectives for the future will make this process a lot easier to set up and stick to.

Once you’ve decided how to spend your money (e.g., save $200 a month), calculate your remaining monthly budget based on your essential spending and income. What will be left after a little math magic is a non-essential, or discretionary budget, to fit your day-to-day wants while meeting your long-term financial needs.

Ex: $2,500 (income) – $1,500 (rent + food + bills) – $200 (savings goal each month) = $800 (remaining non-essential discretionary budget).

Step 4: Divvy up the dough

With a new understanding of how much is in your non-essential, discretionary budget, start divvying up the rest of your income into things you love to do! Set totals for how much you’d like to keep spending on monthly subscriptions, funds allocated to eating out (or ordering in), and how many fruity cocktails you see in your future. The beauty of budgeting is now you know exactly where your money is going – and you can spend it guilt-free with no surprises at the end of the month.

Step 5: Stick to it!

This might be the hardest part of creating a new budget – sticking to it. Try not to judge yourself too harshly as you navigate this new financial framework. If you end up spending more in one area of your life than initially planned (one too many takeout orders?), simply adjust from another one of your non-essential categories that month. Breaking down your budget and being mindful of how you spend is half the battle in a brighter financial future. It’s also important to remember that life is going to have unexpected expenses – and that’s okay because you’re also building up that savings fund! But, if you find yourself in a financial pinch and don’t have your budget quite figured out yet, you can always turn to Moneytree and our financial products for support.

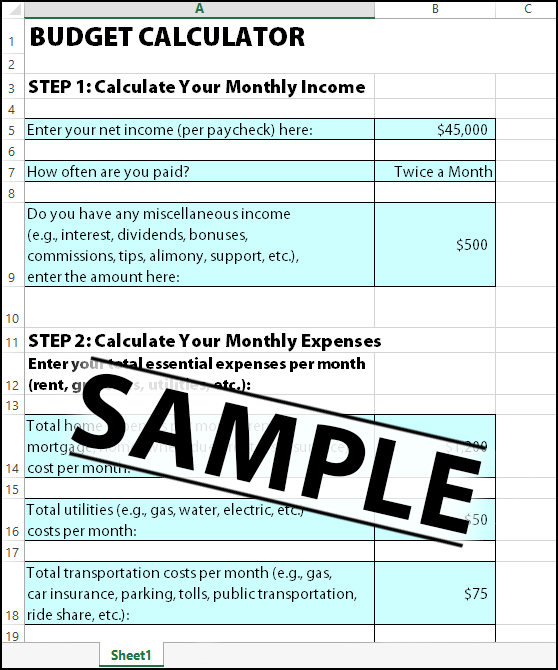

Ready to kick your finance goals into high gear? We saved you the trouble of searching and found a nifty budget tracking tool to take the guesswork out of your new financial guide. If “math magic” just isn’t your thing, this budget calculator tool will become your new best friend.

Bonus tip:

Life comes at you fast! In addition to whatever financial goals you decide to create for your new budget, make an effort to implement an extra $100 of “rainy day” funds per month. You never know when you might need a new umbrella!

Looking for more tips? Moneytree has additional financial guidance for you.

5 comments

Wohh precisely what I was looking for, thanks for putting up.

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

Well I really enjoyed studying it. This information offered by you is very useful for correct planning.

It’s really a nice and useful piece of info. I’m glad that you shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

Some genuinely excellent information, Glad I found this.

Comments are closed.